This week at the 4th Customer Experience in Financial Services Conference our senior account manager, Darren Wake took part in a panel discussion, “capturing the moment with customer feedback”, with Alessandra Canaves from AXA Investments and Lisa Elliott from Lloyds Banking Group.

It was a fantastic discusion about how to guarantee that collecting feedback is both a genuinely positive experience for customers, and a driver of business change that results in increased revenue.

The conversation flowed a bit too well, meaning the session had to end before all audience questions had been answered by the panel. Here’s the questions that Darren didn’t get a chance to address.

Great question. There’s a time and place for both transactional and relationship surveys, but if the focus is service improvement, then transactional is key.

We have an in-depth-guide on this, but fundamentally, you can’t prevent attrition by asking customers about problems they had 11 months ago. They’ve probably already switched to another provider.

Relationship surveys are great for process improvement, but if your focus is improving things for customers, you need to capture and fix issues quickly, which means transactional surveys.

Read our guide: When Should I ask Customers for Feedback?

It’s notoriously difficult to ascribe value to VoC programmes, but that doesn’t mean you can’t demonstrate impact.

First, you need to have robust customer journey maps in place, with transactional surveys at key touchpoints.

Then, at each touchpoint, identify the biggest drivers of customer dissatisfaction.

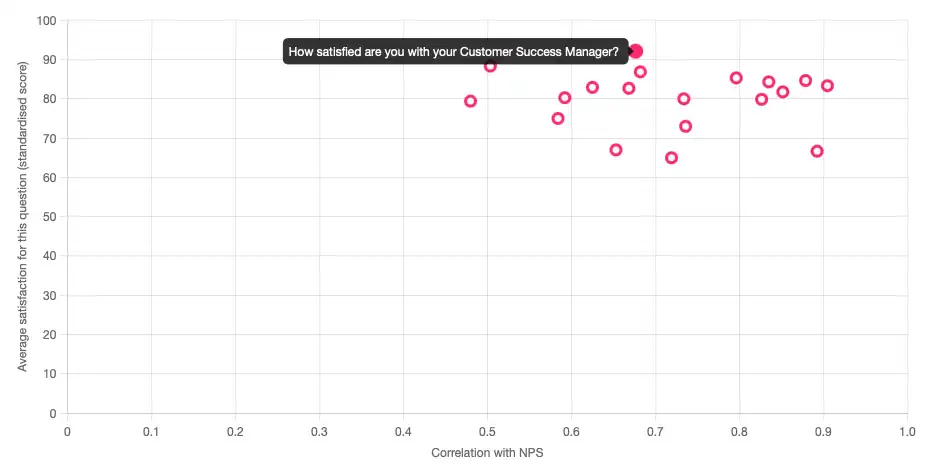

The gold standard approach to this is to ask customers a tiny number of ‘diagnostic’ questions to measure their satisfaction with the fundamentals of customer experience (i.e. clarity of information, cost, your team: whatever is appropriate for the touchpoint) alongside an overall satisfaction metric like NPS/CES.

Then, identify which diagnostic questions are correlated with negative satisfaction, read the associated customer feedback for the gory details, and fix the problem.

GenAI/ML is also effective at finding patterns in unstructured feedback, but needs a human sense-check to ensure it hasn’t ‘hallucinated’ problems that you don’t have.

In a perfect world, you’ll be able to measure churn in this customer journey, and be able to see improved attrition after your changes, but even if you don’t have this level of data sophistication, demonstrating that customers had a specific measurable problem, which you fixed, should go a long way to convincing all but the most skeptical of boards about the value of VoC.

We absolutely work with a number of firms in financial services, who are using feedback to measure positive customer outcomes.

This is something the FCA are very clear they want to see. In their good practice and areas for improvement update, they specifically highlight:

Firms should not be complacent and assume that they can just repackage existing data. We want firms to think seriously about what information they need to really understand their customers’ outcomes and issues they may be facing

We believe this means asking customers transparently how they feel about outcomes (and demonstrating that remedial action has been taken if there are issues)

This is another brilliant question.

We find — through 14 years of implementing VoC programmes — that in general, when customers trust you, they’ll tell you what you need to know.

We can break that down a bit:

First, customers need to trust you: If your comms aren’t clear that you’re trying earnestly to implement a true best-in-class VoC programme, they may be reluctant to give you feedback, believing you’re just going to use their responses to calculate NPS for a board pack, and ignore what they’re actually telling you.

You’ll have to work a little harder to earn this trust if customers have been burned in the past.

Second, they’ll tell you what you need to know. A 100% response rate isn’t desirable, even if it’s achievable. Happy clients may not respond because they have nothing interesting to say, and passive clients are even less likely to complete surveys.

But — human nature — people who have had a negative experience are overwhelmingly more likely to tell you about it. If you want to improve service levels, it’s far more important to capture these negative experiences than positive ones.

This is VoC, not market research. You don’t need to build perfectly statistically-representitive samples of your customer base, you need to find problems and fix them via service recovery or process improvement.

True, this may feel like it artificially lowers your top-level CX metrics… If only detractors are getting in touch, your NPS will be lower than if you only heard from promoters, but this is an issue you can address through organisational culture: You can work (with us?) to get all stakeholders on the same page, understanding that VoC is a powerful diagnostic tool, not a way to generate vanity metrics.

It’s a cliché, but NPS remains good for this.

The original research behind Customer Effort Score claims that it has even greater predictive power, but we’re not in a position to validate that. We like both metrics, they work well in different situations.

A really good metric is ‘trust’, which you can measure simply with questions such as “how much do you trust us to (look after your best interests, do the right thing, etc)”. It’s a good way of establishing your brand reputation.

But remember that CX Metrics are useful as indicators of customer experience, but the only real measures that matter are things like retention, turnover and profit.

NPS (still) works well as a relationship measure, and CES and CSAT are both effective as measures of transactional interactions.

They are well-understood, which means you don’t need to spend time in change management processes bringing the organisation up to speed on your exciting new metric.

Alongside these top-line metrics, you should be asking diagnostic questions to measure the specifics of the customer journey

Read our guide to customer satisfaction metrics.

We can’t speak for the other members of the panel, but we have a suggestion 🙂.

Ready to elevate your VoC programme and ensure success using our expert guide? Learn the three foundations required for success.

Discover more »Connect with a CX expert who’ll help determine your current VoC programme maturity level and provide a 3-step action plan to improve.