If you’re a NPS newbie, or just refreshing your memory, you’ll be an expert by the time you finish this guide.

You’ll learn why the calculation works, how to perform it, and some expert-level tips about when to use NPS, when not to use it, and how to handle tricky topics like non-standard scales.

Calculating your NPS is simple

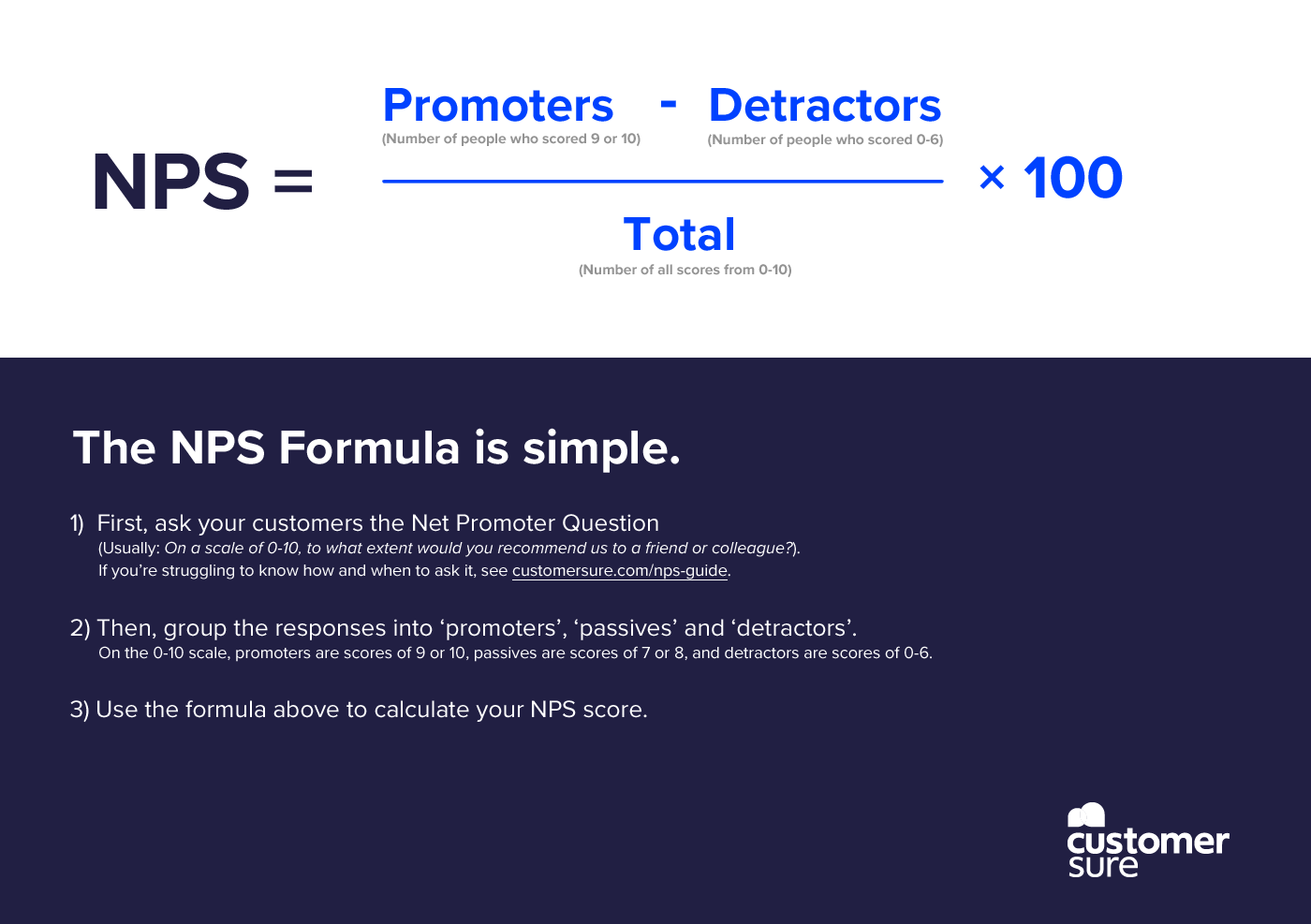

You need two numbers:

Subtract your detractors from your promoters, write the number on a postcard and behold: NPS.

But what are promotors and detractors? When should you calculate NPS? What should you do after you calculate it?

NPS is a fine customer satisfaction methodology, and in the nine years we’ve spent helping mid-market firms develop CX programmes that get measurable results, we’ve seen a lot of NPS: good and bad.

Before you reach for your spreadsheet or our handy online calculator, take two minutes to read this guide and learn what we’ve spent the best part of a decade perfecting. Know for sure that you’re calculating Net Promoter at the right time and in the right way.

We’ll make it worth your while…

When Fred Reichheld was working on the original research which established Net Promoter Score, he noticed that when you ask customers,

“On a scale of 0-10, to what extent would you recommend company x to a friend or colleague?”

The responses to this question naturally clustered into three distinct groups:

Once you’ve got some promotors, passives, and detractors, here’s how you use them to calculate your NPS score:

Speaking of that ‘Recommend’ question,

It wasn’t plucked out of thin air.

A lot of research went into finding out which question had the best predictive power for a company’s future growth.

But if the standard question isn’t right for your business, don’t get hung up on it – what’s important is that you have a question that everyone in your team understands, and you have a straightforward way of grouping the scores from that question into promoters, detractors and passives.

It’s this simplicity that’s important.

Whilst the original research which became NPS showed that the ‘recommend’ question is a good predictor of future growth for most companies in most industries, years of real-world testing and tweaking has shown that the best question is a simple one that gets everyone on your team working towards the same goal: measuring customer loyalty.

If you want to see how different numbers of promoters and detractors affect your NPS score, try using our simple interactive calculator:

For example, if 20 people have scored you ‘9’, type ‘20’ in the box marked ‘9’

This depends on your circumstances. There’s no one-size-fits-all answer, but if you’d appreciate some advice, we love to chat about customer satisfaction and we don’t do awkward, pushy sales, so give us a call? But in general…

The NPS system describes two main types of survey: transactional (every time a customer completes a touchpoint with you) and relationship (surveying a cohort of your customers at a moment in time).

Done well, transactional surveys can replace a lot of the need for relationship surveys. If you’re surveying most of your customers naturally as they interact with you, then a ‘quarterly customer survey’ or ‘monthly customer attitude poll’ isn’t going to tell you a lot you don’t already know.

Transactional surveys give you constant visibility of your live NPS score. Which is nice. But, like any business metric, it’s not helpful to obsess over it day-to-day. So when should you look at it?

You need to make two choices when you calculate your NPS score from transactional surveys:

If you’re calculating over a 12-month window, good scores from the past may pull up your average and mask bad scores you’re getting today. But, calculating month-to-month can give you very volatile data that it’s hard to make sensible business decisions with. As a broad guideline, we’d suggest a 3-month rolling window… But ultimately, the right answer depends on your circumstances.

But always, always remember: It’s great to know your NPS score, but it’s the NPS system that improves customer satisfaction. However you choose to measure things, your primary focus should always be finding and fixing individual customer issues in real time.

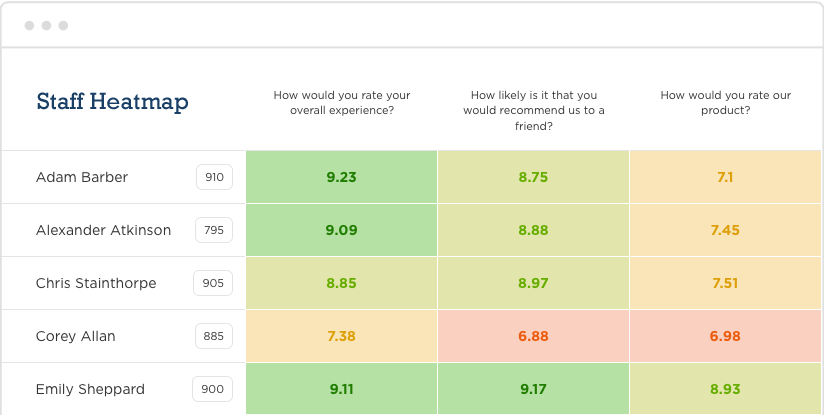

We’ve covered which time period you should calculate NPS over, but there’s another important question: how should you ‘slice’ your team or organisation’s data?

Again, there’s no ‘one true answer’ here – get in touch if you’d like to discuss your circumstances. However, let’s look at some of the factors which shape the answer:

There are arguments for and against this. On balance, we’d advise that you don’t.

Most strongly against is the fact that the traditional NPS question asks would you recommend the organisation?, so it’s unfair to pin the answer to that question to any one person.

You might get better results combining two metrics, asking one question about the organisation (NPS), and another question, for example, CES, about the individual.

In the right setting, we have seen NPS-for-individuals work, though.

In practice though, we’ve seen NPS for individuals can be made to not only work, but deliver brilliant results.

To get it right, there’s a few things you need to be aware of:

People who point out that the NPS question is about the organisation have a point. Be very, very careful about assuming that bad scores mean bad performance, especially when you’re working with a limited amount of data.

We strongly recommend that you ask a few short, customer-centric follow up questions on your NPS surveys, and this is just one of the reasons why.

Asking targeted questions like “How helpful was your advisor today?” alongside general sentiment questions like NPS allows customers to be specific about their feelings. As a customer yourself, have you ever wanted to simultaneously criticise an organisation but praise an individual within that organisation who tried to help you?

You should also never be asking the NPS question without a question for free-text feedback, and this feedback will normally make clear whether the score relates to the individual or the organisation or a whole.

Culture is the single most important factor behing the success (or failure!) of any CX initiative.

Unsurprisingly it’s massively important here.

That individual who keeps getting low NPS scores… Are they a problem? Or are they your star performer who’s fixing more than their fair share of difficult customer issues? Are they a liability, or are they a new starter, who, with a little coaching could be one of your greatest assets?

If your company culture doesn’t support your people, individual NPS could be a morale-destroyer. It’s not great to feel that your peers are judging you on a score you don’t have full control over!

Part of the motivation for NPS is to unite the whole organisation around one key customer-centric number, so it goes without saying that company-level NPS is something which should be shared far-and-wide.

However, unless your company culture is extremely supportive, and people are genuinely looking out for each other, it could be best to keep individual-level NPS scores between advisors and their managers.

Following on from the previous two points, never, ever benchmarking NPS for individuals. As a rule, we’d say that benchmarking satisfaction is a waste of time , and this is doubly-true when attributing scores to individual advisors.

It’s a useful tool to identify team members who might need extra coaching, not an arbitrary score to hold your team to.

And finally, on that note – have you ever had a comment card pressed into your hand and been asked,

Please give me a 9 or a 10… my bonus depends on it!

As a customer, did you feel able to give truthful, helpful feedback in that situation?

Feedback that would help the company improve its customer service?

Or do you just give a 10 and move on with your life?

Never use NPS as a basis for any form of individual incentivisation. People will always try to ‘game’ the system. The best scores will go to your team members who are best at sweet-talking customers, you’ll miss out on a huge amount of constructive feedback, and lose a reliable measure of how satisfied your customers really are.

We’ve got a whole blog post explaining how to calculate NPS on a 1-5 scale!

If it’s a meaningful way of dividing up your business, it can be a useful way of segmenting your NPS. Depending on your circumstances, it can be helpful to compare things like contact centre teams, sites or product lines. But in most cases, the issues we discussed around comparing advisors will still apply, so rememeber:

Unlock actionable insights with our free, expert-crafted 3-Step action plan.

Discover more »Connect with a CX expert who’ll help determine your current VoC programme maturity level and provide a 3-step action plan to improve.